Farm Cash Flow Management: What It Is, Why It’s Important, and How to Do It This is the tool I use for farm cash flow management This is the tool I use for farm cash flow managementRunning a small farm profitably requires more than just being a good grower. To ensure that your farm survives and thrives, you need to follow solid financial management practices. Probably the most important financial aspect to consider is farm cash flow management. In this article, we will examine what cash flow management is, why it’s crucial for small farms, and how to implement effective cash flow strategies to keep your business on a solid financial footing. What is Farm Cash Flow Management?How much do you know about your (current or planned) farm enterprise right now? Do you know how much money your business is making (or needs to make)? Do you know your costs to produce each item your farm sells? Do you know where best to re-invest your profits to generate more income? This is where farm cash flow management comes in. Cash flow management is the process of tracking the money coming in and going out of your business over a specific period. For small farms, this includes understanding how much money you are earning from sales of produce, livestock, or other farm products, and how much you are spending on costs such as seeds, feed, labor, equipment, and utilities. In simplest terms, the difference between your inflows (income) and outflows (expenses) is your cash flow. Why Cash Flow Management is Important for Small Farms

Farm cash flow management isn't just about tracking money. It’s about planning ahead, ensuring that you have enough funds to cover your expenses when they arise, and preventing cash shortages that can put your farm's operations at risk. In my latest course Planning For Profit I make the point that “You can’t manage a process unless you understand it. And you can’t understand it unless you: 1. Plan For the results you want; and, 2. Measure results compared to the plan. What does this have to do with small farm profitability? Small farm owners need to understand the financial implications of their decisions. This enables them to make informed choices. I call this ‘financial literacy’. Financial literacy means you can manage cash flows, track expenses, and make strategic investments. You understand profit and loss dynamics, contributing to long-term sustainability and growth. Small Farms Especially Need Sound Cash Flow Management

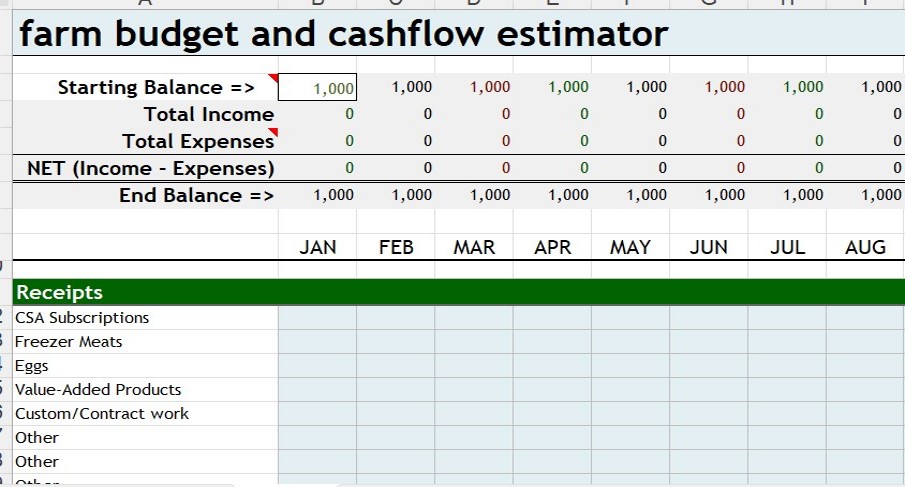

Cash flow management is essential in any business, but especially so for small farms. Here’s why: 1. Seasonal Nature of Farming It’s the nature of our business. Most farms experience high and low variations in cash flow. For example, your market sales may only extend for 25 weeks or so. Most of my CSA income is received before my deliveries start. The income period may be limited but expenses are incurred 12 months a year. Good cash flow management allows you to navigate these fluctuations and ensure that you have enough cash on hand during lean periods. 2. Avoiding Financial Crises Stuff happens. The markets, the weather, and unexpected equipment breakdowns can affect your income and expenses. If you don’t have a handle on cash flow management, you could end up in a situation where you can’t cover expenses like payroll, loan payments, or buying essential farm inputs. The consequences of which are not good. By managing cash flow effectively, you can avoid these financial crises. 3. Support Growth and Expansion Having a clear picture of your cash flow enables you to make better decisions about investing in new equipment, expanding your farm operations, or pursuing other opportunities for growth. In a recent article I wrote about farm side hustles that can increase farm income. You’ll know when the time is right to make an investment in one of these opportunities and how much you can afford to spend without jeopardizing your financial stability. 4. Meeting Debt Obligations Many small farms rely on loans to finance equipment purchases or operational costs. Sound farm cash flow management ensures that you can meet your debt obligations on time, avoiding penalties or damage to your credit score. 5. Tracking Profitability Cash flow management allows you to see how well your farm is performing financially. By keeping track of your cash flow, you can identify trends, see what’s working and what is not-so-much, and make adjustments as needed to ensure profitability i.e. plan for the results you want and track performance against the plan. How to Manage Cash Flow on Your Small FarmNow that we understand why cash flow management is crucial, let’s look at how to implement it effectively on your small farm. 1. Create a Cash Flow Forecast A cash flow forecast is a projection of your farm’s expected income and expenses over a specific period (usually monthly or quarterly). This allows you to anticipate periods when your cash flow might be tight and plan accordingly. Here’s how to create a simple farm cash flow forecast:

By maintaining a cash flow forecast, you’ll have a clearer understanding of when you might face cash shortages, allowing you to take proactive measures, such as moderating your spending or seeking additional income sources. Another name for a cash flow forecast is a budget. The key thing to remember is that building a farm budget is not a set-it and forget-it process. You need to track your farm cash flow consistently, to see how much cash is available at the start and end of each period, and compare this with your forecast to ensure that you’re on track. Farm Cash Flow Management Is A Key Part Of Planning For Profit

Profit is something you plan for. And there is a process to that planning. When I have to do tasks repeatedly on the farm, I create tools to make the process easier. Since I regularly set income goals for my farm and track my sale and income results against the goals, I built some tools to help. In my new Planning for Profit home study course, I've included the Farm Budget and Cash Flow Estimator (see top of page) and a couple other software tools, as well as a guidebook and 4 custom worksheets to help the small grower make their own plan for profit.

|

See Something You Like? Share!

Got questions to ask, stories to tell?

Share your organic market gardening question, or comment, or story.

I'm an affiliate for some products I promote on this site. This means I get a small commission for a product you buy through a link on one of my pages. This doesn't cost the buyer anything, but provides me an additional income to help support these pages.